After you research the domain history, you should break down the total revenue available from purchasing a website to determine how much is being made. This breakdown also provides a visual of where you can strengthen the revenue. If you are serious about Virtual Real Estate, the following considerations are a must. Remember, you make a profit during the purchase, not the sale!

After you research the domain history, you should break down the total revenue available from purchasing a website to determine how much is being made. This breakdown also provides a visual of where you can strengthen the revenue. If you are serious about Virtual Real Estate, the following considerations are a must. Remember, you make a profit during the purchase, not the sale!

Check the Claims Being Made by the Seller

It’s a sad truth that sometimes sellers inflate the worth of their site to make it more appealing to the buyer. Forming a contract between buyer and seller is one way to make sure the claims made by the seller are truthful. If a seller has to sign accurate statements, they are less likely to exaggerate.

Time Estimate for Investment Return

Knowing how long it will take to recover your initial investment before buying the site is hard to determine. If you can estimate an approximate timeframe, it’s better than sitting and waiting it out. A good starting point would be to take the total purchase price and divide it by the monthly Net Profit, or Gross Profit less expenses, for an estimated breakeven analysis.

Yearly Projected Earnings for the Website

Trying to calculate the yearly projected earnings depends on the growth of the revenue – whether it’s declining, booming, or maintaining a steady rate. The best way to estimate this would be to ask the seller for evidence of at least the past three months of revenue and then multiply it by a factor of four for the year.

Note: Do not forget to ask the seller about, and factor in, any seasonal variances – especially for websites related to holidays, vacations, etc.

Earnings That Are Consistent

Serious buyers prefer a consistent revenue stream. A sudden surge from time to time is also good, but no one wants to see their revenue suddenly plummet. Knowing how long the site has been making the current amount of money will be helpful in figuring out the consistency of earnings. A mistake commonly made when buying a site is to purchase it when it is suddenly doing well. This will often provide false hope and will be a tremendous disappointment if revenue declines.

Note: It’s also wise to ask the website owner why the site is being sold. Some owners get too many sites going and need to be free of a few for their own sanity. Others are merely trying to make money.

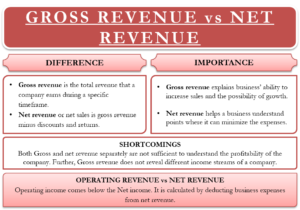

Gross Revenue Vs. Net Revenue

Many sellers will provide gross revenue, drastically inflated, to make the site look like it is doing extraordinarily well. The gross revenue can look impressive, but the amount spent on advertising or site operation can decimate the net profit. For example, gross could be 15,000, but the advertising and operating costs might be up to 12,000. Subtracting these two provides a net revenue of only 3,000 dollars. Going into a purchase with the thought of earning a fistful of dollars regularly from the website isn’t always a good idea. Check the net revenue for a more accurate total.

Gross Revenue Vs. Net Revenue

Bringing in additional help may be possible, but it depends on the budget. Determining what you can do to bring in more revenue creatively is always something to think about. Maybe you can put more of the income towards additional advertising. You may also want to hire the current seller to help keep the site up and running, but to still make money at the same time.

Are There Any Areas with Untapped Revenue?

There may be ways to integrate links into a blog or monetize the traffic generated by a newsletter. Sometimes there are loads of free content you can sell for a profit. There are often plenty of areas with untapped revenue you can develop without spending more money on advertising.

Note: For more on this, refer to my previous article Cash in the Virtual Attic.

In summary, test your own expectations and needs from this transaction. If they’re too high, you may end up going broke or in debt to purchase the website of your dreams unless you confirm it has enough high-quality content.

*Originally published on WorldStart May 19, 2010